Twenty Years Later, Same Same, but Very Different

When we launched the 36ONE BCI Flexible Opportunity Fund in 2005, the market landscape looked very different. South Africa was in a robust growth phase, with GDP expanding at some of the fastest rates in the post-apartheid era, supported by rising consumer confidence, infrastructure investment, and a buoyant resource sector. The JSE was heavily resource-driven, riding a global commodity boom fuelled by China’s rapid industrialisation and surging demand for metals and energy.

Nearly two decades later, global commodity markets are experiencing another boom, this time driven by the energy transition, the rise of electric vehicles, and geopolitical supply shocks. South Africa’s market remains strongly resource-focused, but the forces shaping global demand and valuations have shifted significantly. Back then, the largest listed company on the JSE was Anglo American, while in the U.S., ExxonMobil led the S&P 500 – both icons of resource-driven markets. Today, global indices are dominated by technology companies, highlighting the dramatic shift in the global investment landscape, even as local markets continue to reflect traditional resource strengths.

Locally, the investment universe has also evolved. In 2005, listed stocks outnumbered unit trusts, whereas today registered unit trusts surpass investable stocks. At the time, we were one of just 12 flexible funds in South Africa, representing roughly 4% of the domestic unit trust market. That category has since expanded to 78 registered funds, though their market share has slightly declined to about 3%.

Launching a unit trust in 2005 was an exciting prospect. Global markets were buoyant, the rand traded at R6.27 to the U.S. dollar, interest rates were steady, and investor optimism was high. Yet just three years later, the global financial crisis shook confidence to its core. Over the past two decades, we have navigated defining economic turning points – from commodity booms and political shifts to pandemics and the rise of technology as the world’s new market leader. Through these shifts, the Flexible Fund has evolved, consistently adapting to changing markets and delivering value to our clients.

A Strategy Built for All Seasons

Unlike funds locked into a specific asset class, the Flexible Fund’s mandate has allowed us to shift between equities, bonds, cash, and alternative assets as conditions demand. This agility has been the cornerstone of our resilience, enabling us to navigate both bull markets and downturns.

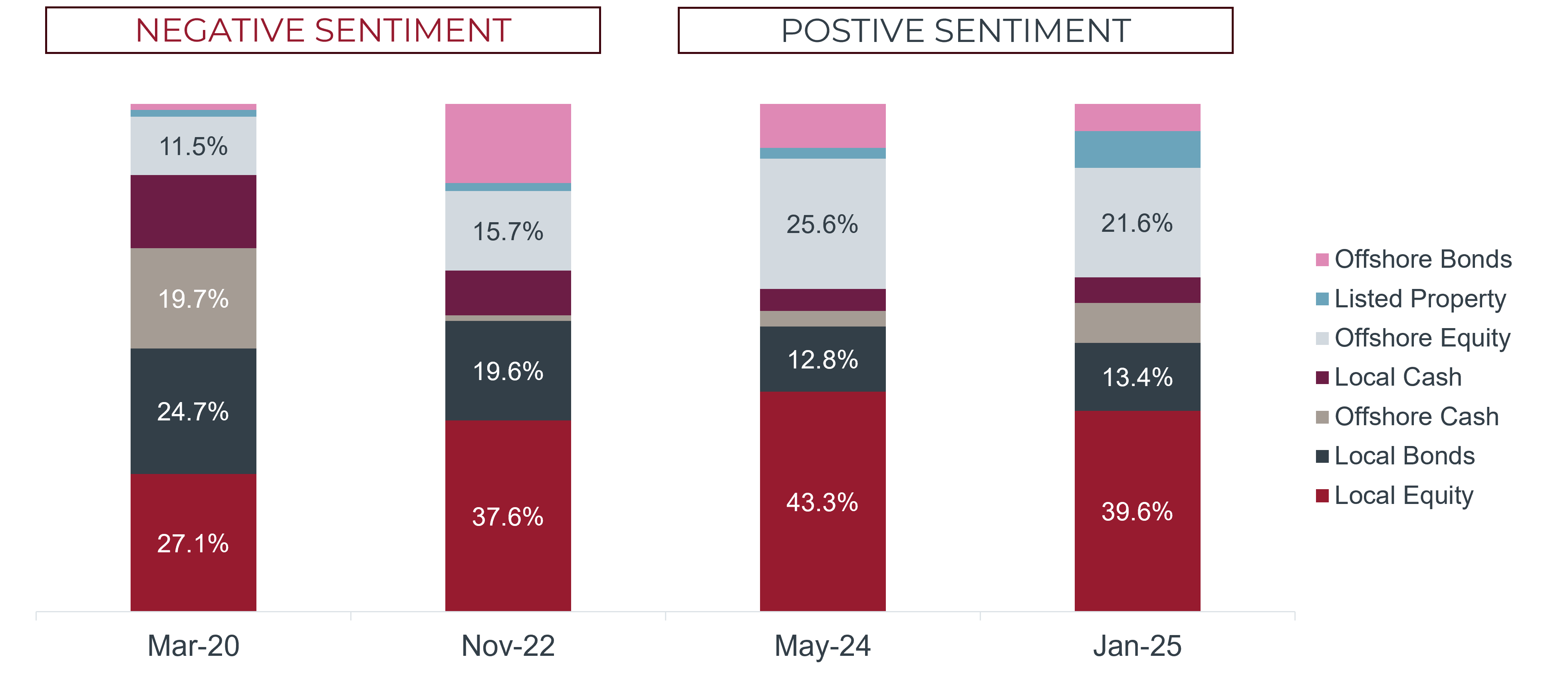

From the outset, the Fund was designed to provide clients with an optimal balance of growth and capital preservation. By dynamically adjusting our asset allocation in response to market shifts, we have consistently delivered strong outcomes. The chart below illustrates how the Fund adapts to both negative and positive market events. For instance, during the COVID-19 market turmoil in March 2020, we strategically adjusted the portfolio to protect capital while positioning for recovery.

This flexibility ensures the Fund is never tied to static allocations. Instead, it is continuously positioned to seize opportunities and manage risk which is a key differentiator across the 36ONE Funds.

An Asset Allocation That Adapts to Changing Markets

A cornerstone of our investment approach is to protect clients during market downturns. In 2008, when markets plunged, the Flexible Fund’s nimble asset allocation helped cushion the blow for our investors. During the COVID-19 volatility of 2020, swift portfolio adjustments enabled us to not only protect clients’ capital but also capture the recovery as markets rebounded. Over two decades, this adaptability has not just preserved capital during challenging periods, but it has also positioned the fund to seize opportunities when others could not.

Beating Its Peers and Inflation While Weathering the Storms

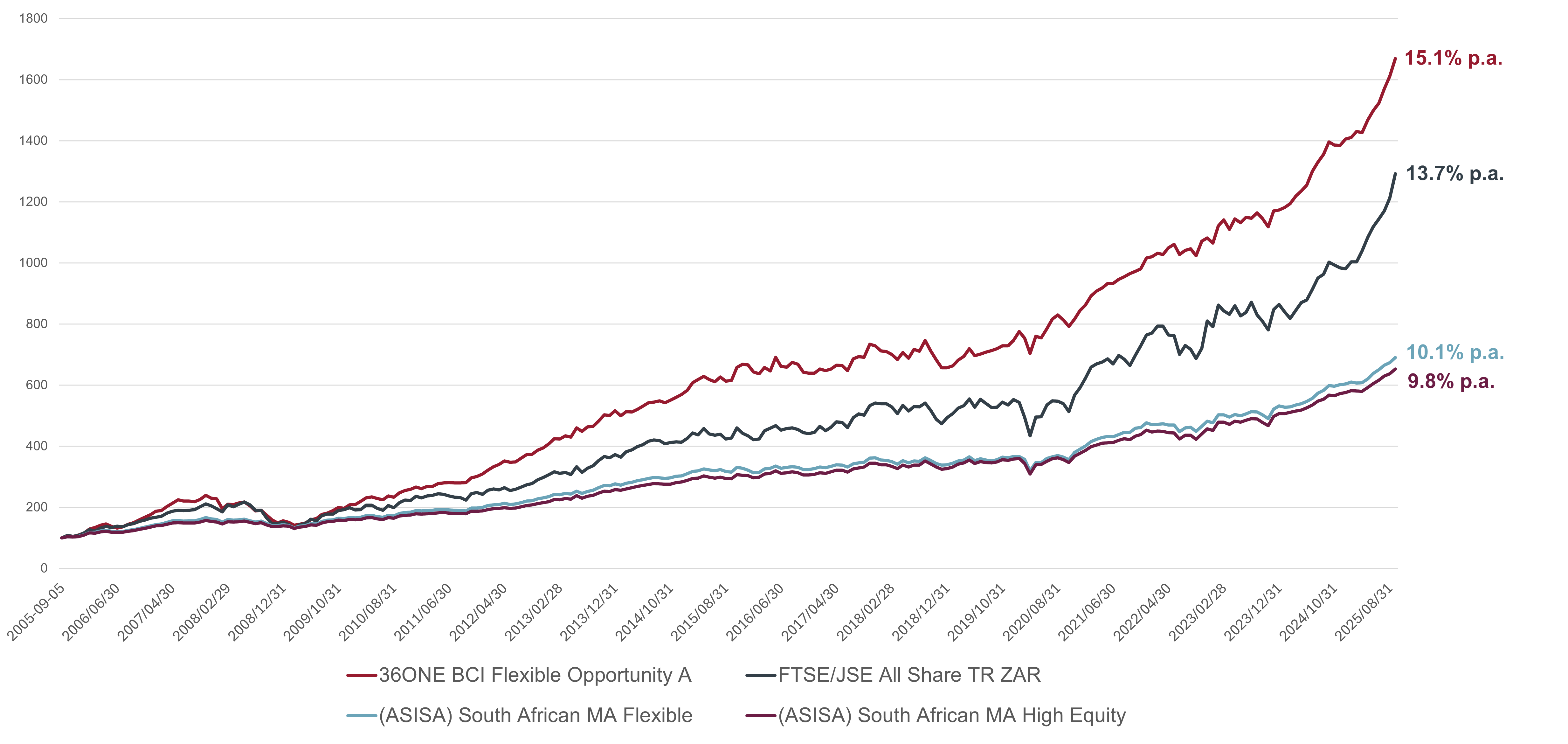

Since its inception in 2005, the Fund has delivered exceptional long-term performance – compounding at an annualised 15% net of fees to September 2025. Importantly, this has been achieved with lower volatility levels compared to the local equity market, underscoring the Fund’s ability to generate strong growth while managing risk effectively.

Relative to peers, the Fund’s record is even more compelling: over the same period, the average ASISA Flexible Fund returned 10.1%, and the average Balanced Fund 9.8%. The Fund has delivered approximately 5% of annual excess return in comparison.

As illustrated in the chart below, the power of compounding over two decades has resulted in meaningful and sustained outperformance of both the market and peer groups. The outcome is a compelling record of consistent, superior risk-adjusted returns year after year.

The People Behind the Performance

The Fund’s track record is a direct result of the team behind it – their expertise, continuity, and commitment make the difference. In fact, the core group who launched the fund back in 2005 are still very much involved today. That’s rare in our industry, where many peers maintain long-standing brands, but the individuals behind those brands often change over time. A few years ago, we made a conscious decision to strengthen the team and build for the future. As part of our succession planning, we welcomed Tumi Loate and Steven Hurwitz as co-portfolio managers, working alongside Cy Jacobs. This approach ensures that while we evolve, our foundations remain strong.

Investing With Our Clients in Mind

The Flexible Fund has always been more than numbers on a page. Behind every investment decision is the knowledge that our clients entrust us with their goals, from building retirement security to funding education or preserving wealth for the next generation.

For some of our longest-standing investors, the fund has been a constant companion on their financial journey – helping them navigate life’s milestones with greater confidence.

Looking to the Future

The next 20 years will bring challenges we can’t yet imagine. Technological disruption, shifting global power dynamics, climate considerations, and potentially even new asset classes. But one thing is certain, adaptability and flexibility will remain our greatest strength.

We are committed to refining our approach, embracing innovation, and keeping our clients at the heart of every decision.